financial tips

There is a lot to know about finances. That’s why we have dedicated blogs about managing your finances, covering robust financial tools, ways to manage debt, and how to navigate milestone purchases.

Financial Tips & Advice

Honor Guide: Which Checking Account Is Right for You?

Whether you’re opening a new account or already have one with Honor Credit Union, this guide will help you figure out which checking account fits your lifestyle right now.

10 Genius Ways to Use Your Tax Refund (That Future You Will Thank You For)

Here are 10 smart ways to make your tax refund work for you—instead of watching it disappear in a Target shopping spree.

Building Credit Like a Boss

A lot goes into building good credit, but don’t worry—we’re breaking it all down. You’ll learn how to build credit, what mistakes to avoid, and how to keep your score in tip-top shape!

Labor of Love: Pregnant Homebuyer Signs On Dotted Line Between Contractions!

Learn how Honor can help you overcome any obstacles and get you into the home of your dreams this year.

Fraud Prevention: Person to Person Payments

Learn how to protect yourself when paying friends with person to person payments.

Your Ultimate Guide: How to File Your Taxes

This guide will help you gather the information you need to file your taxes. We also included discounts on services that make filing hassle free. Start now and get organized to make filing your taxes a breeze!

It’s Tax Time. Are You Ready To File?

We have eight tips to help you file your taxes, including what documents you need, when to file, discounts on filing, and more!

How to Maximize Your Honor Checking Account Bonuses: A Complete Guide

Learn how to maximize your checking bonus and make the most of all the benefits your account has to offer.

Downsize your credit card debt with 1 simple step

Learn how a credit card balance transfer can help you get out of debt sooner!

2 Rewards Cards to Keep ‘Top of Wallet’ in 2025

Learn if a credit or debit card is the best option for your wallet.

Unlock Holiday Savings with Honor

When you’re Christmas shopping you can earn double cash back with Select Rewards Credit Card, build your savings while you shop, track spending with MoneyMap, and more!

Why People Never Go Back to a Bank After Joining a Credit Union

Learn the four key differences between a credit union and a bank and what that means for you and your money.

Take Control of Your Debt with a Credit Card Balance Transfer

Imagine consolidating your debt into one manageable payment. Here’s everything you need to know about credit card balance transfers.

Smart Black Friday Shopping Tips for 2024

The key to making the most of Black Friday offers is preparation, so we’ve rounded up some tips to help you stay on budget while maximizing your savings.

Protect Your Money: How to Freeze Your Credit

Have you ever gotten a letter saying your personal information was involved in a data breach? If so, you’re not alone—over 350 million people in the U.S. were affected in 2023!

Use Debit Card Round Up To Build Your Savings

Learn how Honor’s free Debit Card Round Up solution can help you build up your savings by rounding up a debit card transaction to the nearest dollar.

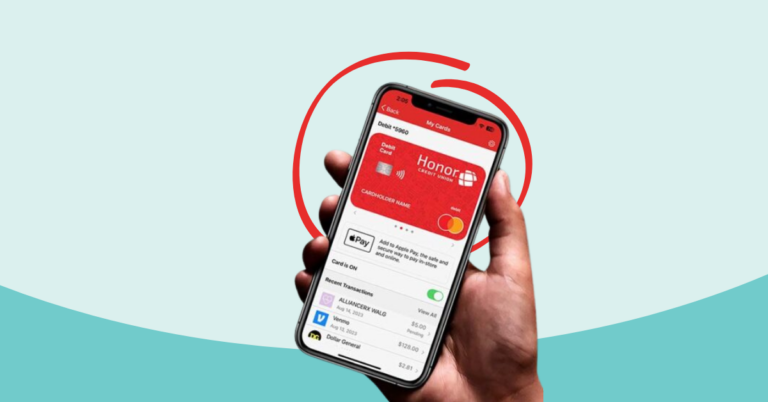

Introducing CardHub: A Better Way To Manage Your Cards

On Tuesday, November 7th, our existing Card Control feature within the mobile app will be replaced with a more-robust solution known as CardHub.

What Is a Contactless Card & What Do I Need To Know?

Learn what a contactless card is, how it works, how to use it, and what the security benefits of contactless card payments are in this blog post.

Six Ways To Manage Your Debt

Read tips about how Honor can help you create a budget, manage your loan payments, prepare for your financial future, and even start saving money.

Five Smart Ways To Use Your Tax Refund Money

It’s important to prioritize how you spend your tax refund money, from paying off debt to building an emergency fund and much more.