Fraud can happen to anyone at any time and with fraudulent attempts on the rise worldwide, we want to make sure you’re prepared and you know what to do if and when fraud may cross your path.

The best way to protect yourself from fraud is knowing what signs to look for and what to do to protect your personal information.

The most important thing to remember is when in doubt, throw it out!

What is Smishing?

Smishing is a type of phishing attack that involves text messages (SMS) to deceive victims into revealing personal information, downloading malicious software, or participating in fraudulent activities. The term “smishing” is a combination of “SMS” (Short Message Service) and “phishing.”

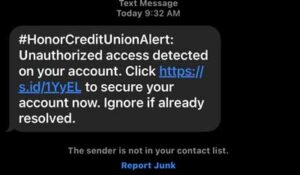

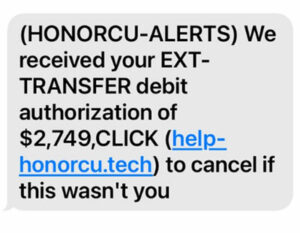

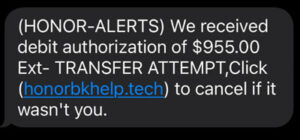

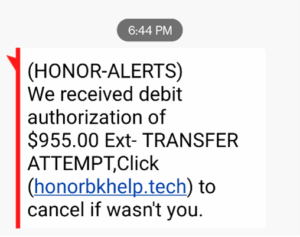

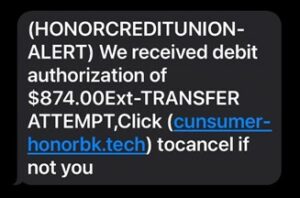

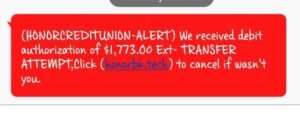

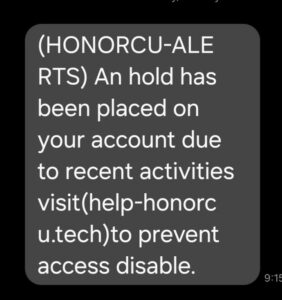

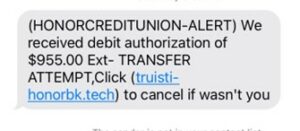

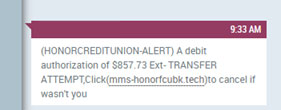

Examples of Phishing Attempts

If you receive a message like one of these screenshot examples below DO NOT CLICK on any links, or engage in any way. Call us immediately at 800.442.2800.

Below are best practices to protect yourself from fraud, how to combat it, and steps you can take to prevent it.

Don't Trust Every Call, Text, Or Email You Receive!

If you receive a call or text from an unknown number or even a number you know and trust, be on alert with the questions you’re being asked.

Fraudsters and bad actors are known for mimicking numbers you know and trust and asking the right questions to gain access to your bank account or personal information.

If you receive a call about your account, hang up immediately and call Honor Credit Union directly at 800.442.2800, or stop by your closest branch.

If you receive a text asking for any of this information, do not click on any links, delete the text and please let us know by calling us at 800.442.2800.

Use Strong Passwords

- Use a long passphrase: According to National Institute of Standards and Technology (NIST) guidance, you should consider using the longest password or passphrase allowed. For example, a news headline or even the title of the last book you read. Then add in some punctuation and capitalization.

- Don’t make passwords easy to guess: Do not include personal information in your password such as your name or pets’ names. This information is often easy to find on social media, making it easier for cybercriminals to hack your accounts.

- Get creative: Use phonetic replacements, such as “PH” instead of “F”. Or make deliberate, but obvious misspellings, such as “enjin” instead of “engine.”

- Unique account, unique password: Having different passwords for various accounts helps prevent cyber criminals from gaining access to these accounts and protect you in the event of a breach. It’s important to mix things up—find easy-to-remember ways to customize your standard password for different sites.

Set Up Activity Alerts For Your Credit & Debit Cards

Setting up actively alerts on your debit or credit card can help you catch fraud the minute it happens and allow you to shut it down before it goes any further. If you see suspicious activity on your account, lock your card down immediately by logging into the Honor Mobile App and accessing our Manage My Cards tool.

Manage My Cards Features

Here are just some of the security features of Manage My Cards to help you keep your debit and credit cards safe:

Real-Time Alerts

Receive real-time mobile app alerts or email notifications every time your card is used.

Reset Your Pin

Within Manage My Cards, you can easily reset your pin to keep your account safe and secure.

Turn Cards On/Off

You’re in control! Quickly and easily immediately turn your card(s) on/off with just the swipe of your finger.

Manage Travel Plans

If you’re travelling out of state or internationally, notify us within Manage My Cards to make sure your card(s) are not restricted during your trip.

Redeem Reward Points

Members with reward-eligible credit and debit cards can redeem reward points without the need to enter separate username/password.

View Spending Insights

Develop healthier spending habits or simply keep track of card usage by quickly seeing how, when and where you spend.

Learn More About Manage My Cards and Other Fraud Protection

Learn how we will contact you if we suspect fraudulent activity, how to easily set up card control, and more!

Don't Download Suspicious Files

Opening files attached in texts or emails can be extremely dangerous, especially when it’s unexpected or from an unknown source. Fraudsters often disguise themselves as a company or organization you use often, such as your financial institution, phone company, or delivery service like FedEx. Clicking on links from an unknown source can open you up to malware and viruses on your device as well as provide them with access to your personal information.

- Always Remember: When in doubt, throw it out!

Never Send Money To An Unknown Source

If you’re asked to transfer money to someone you don’t know, chances are you’re in the middle of a scam. While this could be disguised as a trusted company on the phone or a friend on social media, look for all of the signs that point to this being illegitimate and stop the conversation immediately.

Activate Multi-Factor Authentication (MFA)

Enable MFA on all your existing online accounts. This additional layer of security requires a second form of verification, making it harder for unauthorized individuals to access your accounts.

Closely Monitor Your Credit Score & Report

Credit monitoring can help you spot errors or signs of identity theft so you can take the steps to quickly address them. As a perk of being an Honor member, you have access to check your credit score for free 24/7 within online banking and on the Honor mobile app.

- CHECK YOUR SCORE: Learn how to check your credit score in online banking & the mobile app

- Use Your Credit Report as a Tool: Did you know you can freeze your credit lines to prevent unauthorized access to your credit report and reduce the risk of identity theft? Learn how by reading this article: Credit Freeze or Fraud Alert: What’s Right for Your Credit Report? by Federal Trade Commision Consumer Advice.

We also recommend pulling your credit report from www.annualcreditreport.com. You are allowed one free pull each year.

Want to Learn More Security Tips?

We understand the world of fraud can be a complex topic. We’re here to help. Always remember, when in doubt, throw it out!

Remember to regularly monitor your financial statements and credit reports for any unusual or unauthorized activity. If you notice any discrepancies or suspicious behavior, promptly report it to your financial institution.

If you have other questions, give us a call at 800.442.2800, or visit our Contact Us page for other options to talk with us!