What Is a Contactless Card & What Do I Need to Know?

Contactless cards, otherwise known as the tap-to-pay method at checkout, are a fast and more secure way to make a payment. We want to make sure you understand the benefits, how to use them, and answer other common questions you may have.

What is a Contactless Card?

A contactless-enabled card allows you to tap your card on the payment terminal to complete a purchase rather than inserting or swiping it. Not only is this a more convenient and quicker touch-free payment method, but it is also more secure. Keep reading to learn about the security features.

How Do I Process a Contactless Payment?

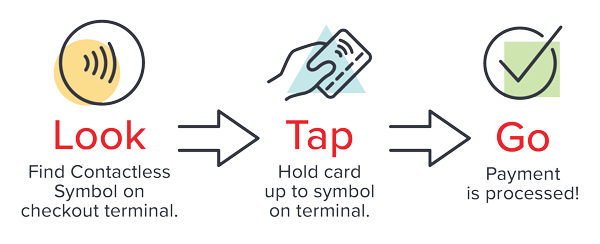

Processing contactless payment is easy:

- Look for the Contactless Symbol on the payment terminal.

- Tap, hold, or wave your contactless-enabled payment card close to the payment screen where you would normally swipe/insert it.

That’s it! If successfully processed, the payment terminal will confirm that you’re good to go – it’s that easy!

How Do I Know if my Card is Contactless Enabled?

Look for the Contactless Symbol on the front of the card. It looks a lot like the symbol for a Wi-Fi signal. Honor’s debit and credit cards issued on or after October 1st, 2023, are enabled with contactless technology and will display the contactless symbol.

What Are the Benefits of a Contactless Card?

It’s speedy! It’s typically twice as fast as chip readers. Hold your card near the card terminal, and within seconds, your transaction is complete. Speedy checkout for the win!

It’s more secure. With each transaction made, tap-to-pay generates new one-time data, making it more difficult for a scammer to duplicate your information, helping protect you from the risks of fraud.

How does contactless payment technology work?

You’re able to make payments this way because contactless cards contain a chip that generates a unique code with your payment information. Radio frequency and near-field communication technology then transmits this code to the checkout system. Your card information is electronically transmitted, allowing you to complete the payment by holding your card near the contactless symbol at the payment reader.

What if contactless payments aren’t available at check out?

While contactless payments are becoming more and more popular every day, your contactless card can still be inserted or swiped to complete payment. Contactless payments are just another way to pay, not a replacement.