Financial Wellness

We have partnered with GreenPath Financial Wellness to help you navigate every financial situation. Start climbing out of credit card debt, consolidate multiple loan payments into one monthly payment, review your student loan repayment options, get bankruptcy assistance, and much more! It all starts with a FREE call.

LearningLab+

LearningLab+ is a free online learning portal from GreenPath Financial Wellness that allows you to learn at your own pace. This easy-to-use educational experience can help you manage money more effectively. With a “Choose Your Own Adventure” feel, LearningLab+ can help you with numerous financial topics and inspire you to achieve financial success!

How LearningLab+ Can Help

- Learn money management basics.

- Build financial habits to improve financial health

- Prepare for a big purchase, such as a car or house.

- Reduce anxiety associated with seeking financial help.

- Accessible 24/7 so you can learn at your own pace.

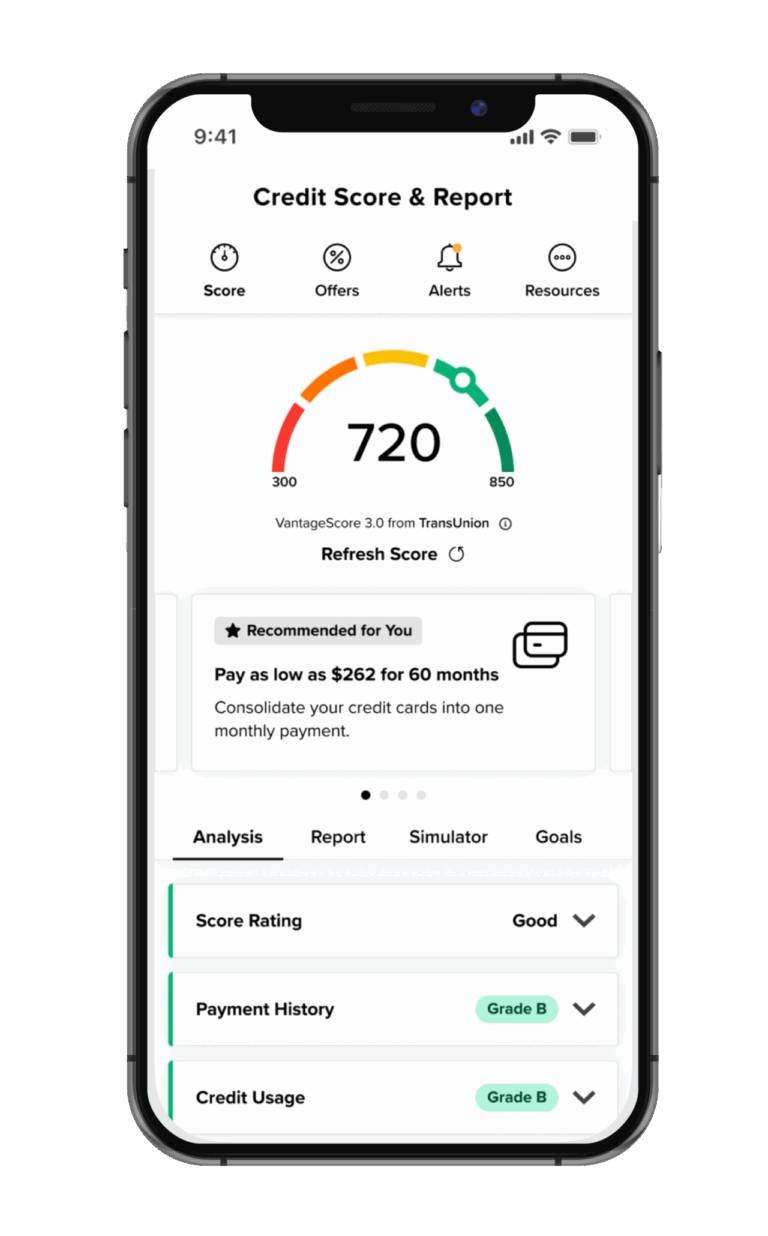

Credit Score Help

Contrary to popular belief, there is no “quick fix” when it comes to improving your credit score, but our partners at GreenPath can help you understand the things you can do to see real lasting results.

How GreenPath Can Help

- Learn how your credit score is calculated, how your information is reported, and who can see it.

- A GreenPath credit counselor will walk you through a FREE review of your credit report.

- A credit counselor will put together a personalized plan to help you improve your credit score.

Pay Off Debt

Our partners at GreenPath have built one of the most trusted debt management programs. Like us, GreenPath knows you don’t fit in a box and that’s why we’re confident they can build a plan that works for your situation to help you eliminate debt.

How GreenPath Can Help

- Stop collection calls

- Work one-on-one with an expert to build a personalized debt management plan

- Calculate your payoff

- Save money on interest charges by paying off debt faster

- Get answers to frequently asked questions

Schedule a Free Call

If you don’t have time to talk to a GreenPath expert right now, you can easily schedule a future call. Simply fill out this form to set a date and time that works for you!

GreenPath Budgeting & Money Tips

- Webinars – Free to everyone, these expert-led webinars give you the opportunity to learn how to manage your money and meet your financial goals.

- Calculators – Free tools to help you budget, save money, and prepare for the future.

- Online Classes – Prepare to buy your first home, climb out of debt, and learn other ways to manage your money by taking an online class.

- Much More – From articles, to FAQs, and newsletters, GreenPath has the resources to help you manage money and reach your financial goals!