$250 Checking Bonus*

Get a checking account that pays you! Whether you want rewards or high interest – you’ll get $250 bonus for opening a new checking account at Honor

Not a member? We're happy you're here! Click below to get started with your account today

Already an Honor member but don’t have a checking account? Let's get you started with one!

How to Earn Your Bonus

A $250 bonus for opening a checking account might sound too good to be true, but it’s absolutely real! Discover just how easy it is to get started.

Not a member? We're happy you're here! Click below to get started with your account today

Already an Honor member but don’t have a checking account? Let's get you started with one!

Two Great Checking Accounts

Whether you’re looking to maximize the interest earned on your account or to reap the benefits of rewards, we have an account option for you!

Like to stash your cash in a checking account and rock that debit card? Benefits checking is the account that will earn you some serious interest!

Don't keep the bulk of your money in checking? No problem! Keep what you want in Connect checking and get rewards from your everyday spending!

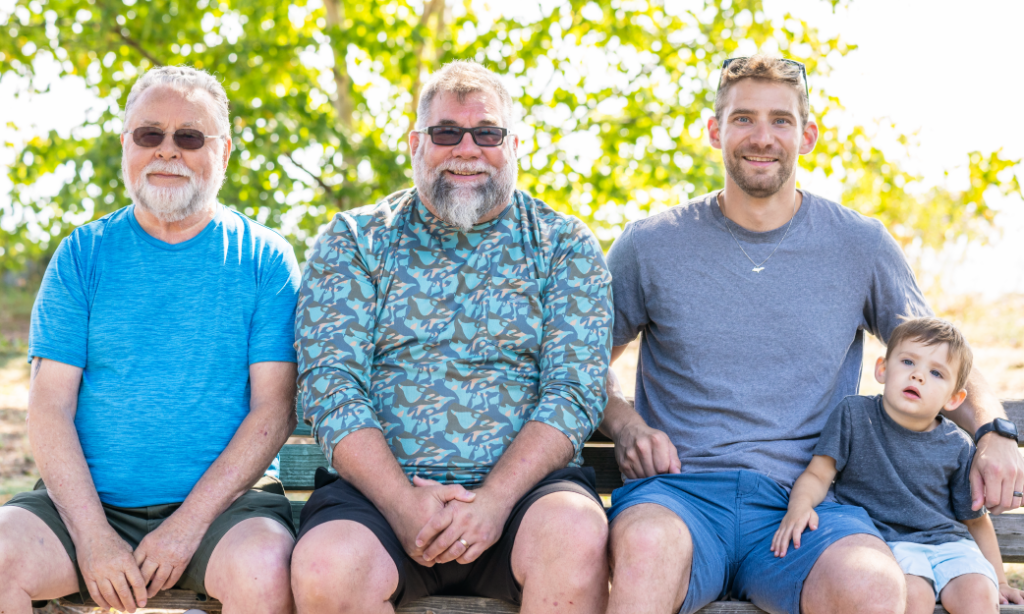

What Folks Are Saying

I have been a member of Honor Credit Union for ten years now. It is composed of the friendliest, most understanding and "real" staff of any financial institution I've ever used.

One of the best bank experience I have had. Stacy the branch manager is such a wonderful and caring person. We will never go anywhere else again.

Honor CU made our vehicle purchase the best!! They went above and beyond!

I absolutely love the customer service here!!!!

Definitely the best customer service I've had from a bank or credit union. Everyone's always helpful and their Member Specialists are great to work with when necessary.

First time mortgage and it was soooo easy. They were on top of everything and with me every step if the way! Highly recommend

Ready to Open a Checking Account?

Not a member? We're happy you're here! Click below to get started with your account today

Already an Honor member but don’t have a checking account? Let's get you started with one!

Why Honor?

At Honor, you can unlock life’s potential, where your membership not only strengthens the community but also amplifies your financial well-being.

When you choose Honor, you’re choosing better banking—and to be truly valued. Our members are our top priority.

Like you, our home is Michigan and with 28 Member Centers to choose from, your neighbors are our neighbors.

With our top-tier technology and easy access to your funds, you'll feel empowered and supported every step of the way.

*APY = Annual Percentage Yield, 0.00% APY. $250 paid when new or existing member without a current checking account opens a personal checking account with a minimum opening deposit of $25, sets up qualifying direct deposit(s) totaling $500 or more and conducts 8+ debit card transactions all within 60 days of account opening. A qualifying direct deposit is defined as one from a recurring paycheck, pension, or government benefits (such as social security) payments only. Non-payroll related ACH, person-to-person payments and transfers from other financial institutions or other Honor CU accounts do not qualify. Bonus will be paid within 30 days of minimum requirements being met. New account must remain open and maintain a positive balance for at least 90 days. If criteria is not met, $250 bonus will be withdrawn from account. New members must open account at honorcu.com/bonus/ or a local member center location. Existing members must open new checking account at member center location, phone, or video appointment, and specifically mention the $250 offer at time of opening. Existing members that have closed a checking account at Honor in last five years, not eligible. Offer subject to change without notice. The value of the reward may be reported on the appropriate Internal Revenue Service (IRS) forms and may be considered taxable income to you. Please consult your tax advisor regarding your specific situation. Insured By NCUA.

1:APY = Annual Percentage Yield. Rates accurate as of 11/1/24, $25 minimum deposit required to open. Earn the 5.15% APY on balances of up to $10,000.00. Members not meeting the Dividend Requirements will not earn dividends. Dividend Requirements are e-Statements, Direct Deposit, at least 20 debit card transactions per month that clear your account as signature-based or PIN-based point of sale (POS) debit transactions (PIN-based ATM transactions not eligible; please note that Honor posts transactions based on how they are received from merchants) and minimum 1 monthly online banking login. ^ATM foreign surcharge fees will be refunded monthly up to $20/month. Members not meeting requirements will not earn ATM foreign surcharge fee refunds. No free checks offered on this account. One account per Member. Rate is variable and may change after account is opened. Insured by NCUA.

2: APY = Annual Percentage Yield. Rates accurate as of 11/1/24, $25 minimum deposit required to open. Account earns 0.00% APY. Members earn 1 reward point per every $1 spent on qualifying net debit card purchase transactions (purchases minus returns/credits) posted to their Connect Checking accounts as signature-based or PIN-based point of sale (POS) debit transactions (PIN-based ATM transactions not eligible; please note that Honor posts transactions based on how they are received from merchants). Qualifying purchase transactions are defined as those retailers whose Mastercard Merchant Category Codes (MCC) are classified as follows: Grocery Stores, Supermarkets, Restaurants, Fast Food, Drinking Places, Discount Stores, Variety Stores, Wholesale Clubs, Pharmacies, and Gasoline (gas stations, EV charging stations). All other debit card transactions will not accrue reward points. Account holders are advised to refer to the uChoose Rewards program terms for comprehensive details on point redemption, limitations, expiration, and other pertinent information. Some restrictions may apply. Insured By NCUA.